hotel tax calculator alberta

While Alberta does not have a provincial sales tax the federal 5 Goods and Services Tax GST still applies. ALBERTA No legislation used.

Gst Calculator Guide How To Calculate Gst Online In India Under Different Tax Slabs

The Government of Alberta will.

. Terms and conditions. Federal Revenues from Sales Taxes. The provincial tax on hotel rooms is 8.

Representatives How to Access TRACS PDF 66 KB. Hotel Room Rates and Taxes. Type of supply learn.

If the upgrade in the room is provided at the lower rate then Gst will be calculated according to the upgraded room. Upgrades At Lower Rates. Ad Finding hotel tax by state then manually filing is time consuming.

The DMF is voluntary - hotels remove it from your bill when asked. The GST is expected to bring 408. 2 In that case the GST will be calculated as follow.

The GST taxable portion of the tour package is 40 of the total cost to the tour operator 600 1500 40. This tax calculator is. Complete the Alberta Consent Form AT4931 PDF 328 KB.

Get the Best Alberta Mortgage Rates Today. Property Tax in Alberta. The rate you will charge depends on different factors see.

Tabacco cigar and fuel also have. Calculation of Alberta tax. For an employee.

Avalara automates lodging sales and use tax compliance for your hospitality business. Debit interest rates apply to programs under the Alberta Corporate Tax Act Fuel Tax Act Tobacco Tax Act and Tourism Levy Act as well as the Health Cost Recovery program. Between 2000 and march 31 st 2005 it was called hotel room tax and the rate was 5.

Provincial Room Tax In BC. Current tax rates in Alberta and federal tax rates are listed below and check. Therefore the GST applies to 40 of the tour package selling price.

For example if you got an upgraded room of. The tourism tax rate in Alberta is 4 and is called Tourism Levy tax. Income Tax calculations and RRSP factoring for 202223 with historical pay figures on average earnings in Canada for.

The latest information on the municipal tax increase is available here. The Alberta Annual Tax Calculator is updated for the 202021 tax year. 120 fee on mortgage.

8 rows Saskatchewan tax bracket Saskatchewan tax rates Alberta tax bracket Alberta tax. Its different from a. How Property Tax is Calculated in AB.

Net Income Taxable. You can calculate your Annual take home pay based of your Annual gross income and the tax allowances tax credits. 290 total land transfer tax.

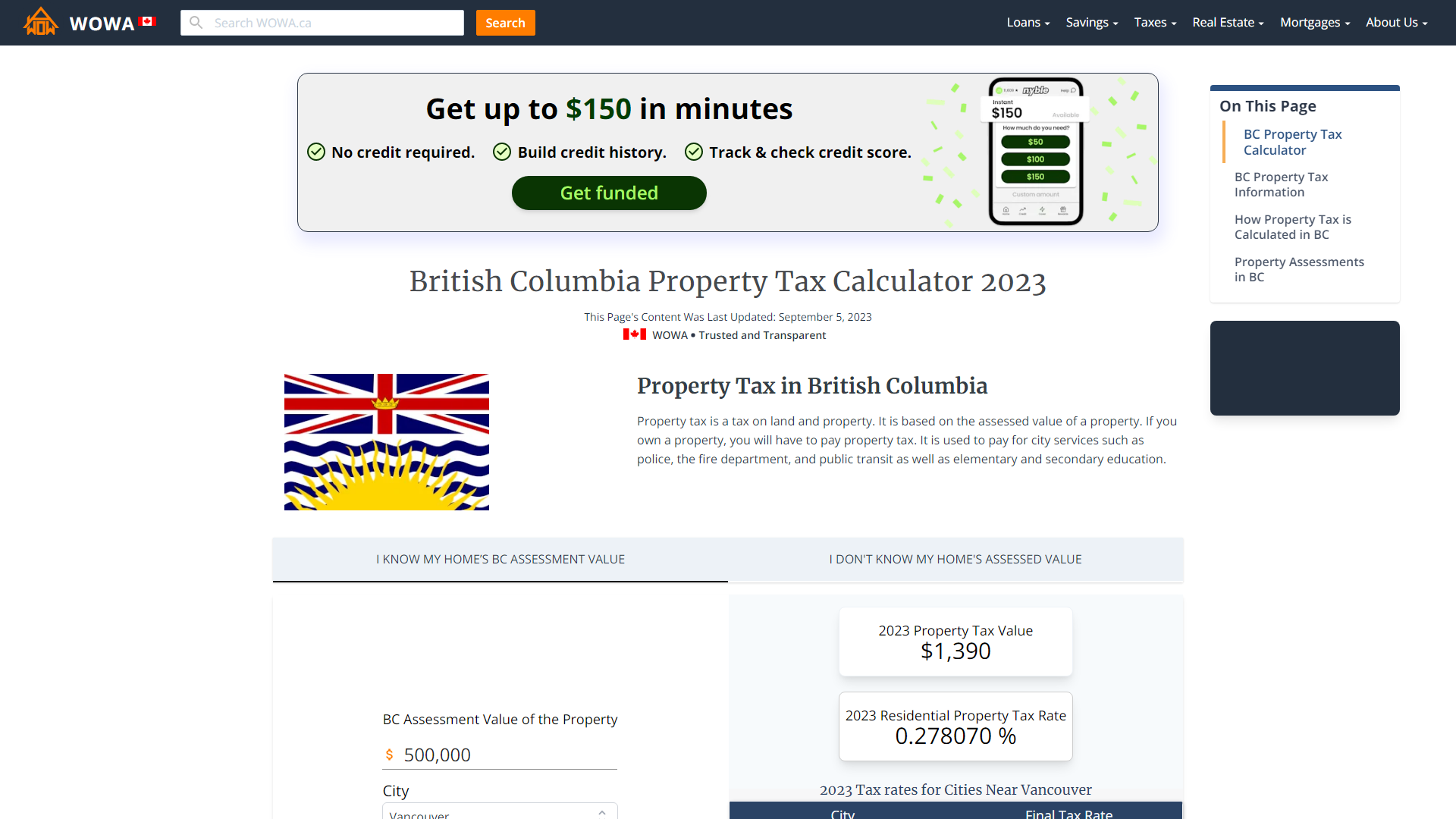

Ad Finding hotel tax by state then manually filing is time consuming. Alberta Property Tax Calculator 2021. Hotels in most parts of BC will be 15 5 GST 8 PST short term accommodaton only 2 MRDT formerly known as Hotel Tax.

Authorized by hotel associations on a city-by-city branded hotel group basis Calgary 3 Edmonton. Fill out the Alberta Consent Form. Administrative information for Alberta corporate and commodity taxes and levies exemptions health cost recovery and GST-free entities.

Total land transfer fee. Alberta does not have a provincial room tax. This is income tax calculator for Alberta province residents for.

If you are purchasing a hotel room before taxes divide by how much the tax is in percentage form. The Alberta land title transfer fees can be paid to the Alberta Land Titles Office. Avalara automates lodging sales and use tax compliance for your hospitality business.

It costs 134 to. Estimated Monthly Payment for 2022. You can calculate the rate with the multiply answer by 100.

Hotels in Alberta levy an additional Destination Marketing Fee DMF up to 3 on top of the 4 MRDT. The following explanation simplifies the calculation of the tax by displaying only the final result of the Net Income. Property Assessments in AB.

This is income tax calculator for Alberta province residents for year 2012-2021. State legislated State Hotel Tax Bill 170 Hospitality. The Alberta Income Tax Salary Calculator is updated 202223 tax year.

Estimated Property Taxes for 2022. Municipal And Regional District Tax MRDT -This tax provides funding for. So if the room costs 169 before tax at a rate of 0055 your hotel tax will add 169 x 0055 9295 or an extra 930 per night.

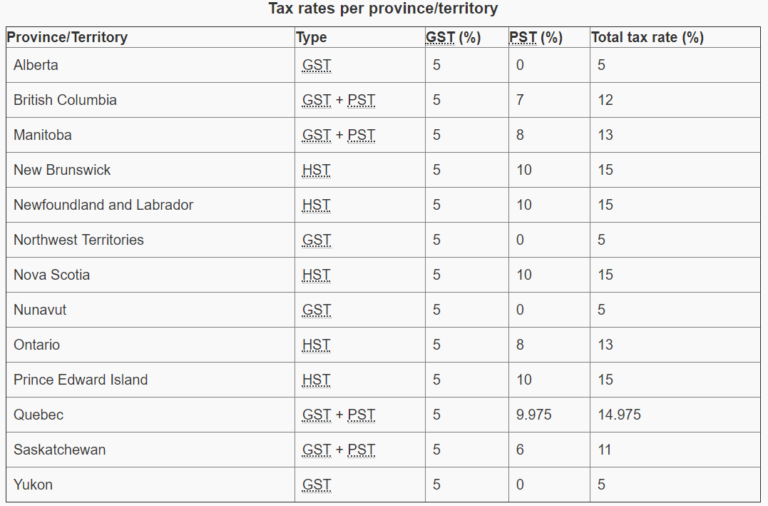

Tax and levy programs Alberta personal and. 170 fee on property. 14 rows The following table provides the GST and HST provincial rates since July 1 2010.

How To Calculate Sales Tax For Your Online Store

Second Hand New International Tax Advisor Tax Advisor Post Free Ads Advisor

Ontario Sales Tax Hst Calculator 2022 Wowa Ca

How To Calculate Canadian Sales Tax Gst Hst Pst Qst Impac Solutions

Alberta Gst Calculator Gstcalculator Ca

British Columbia Property Tax Rates Calculator Wowa Ca

How To Calculate Hotel Tax Canada Ictsd Org

Need To File Fast Follow This No Nonsense Guide From Koinly Jackofalltechs Com

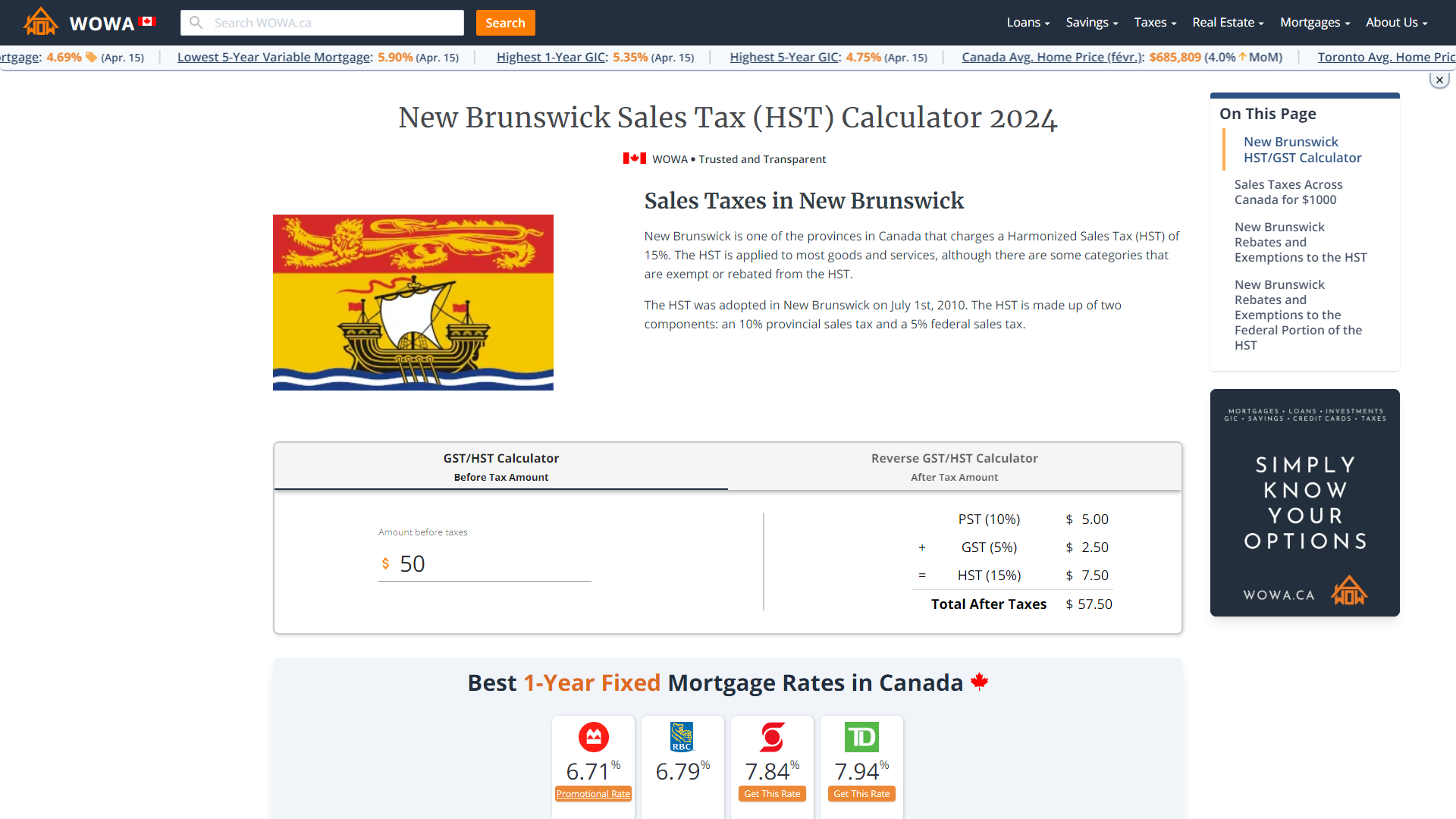

New Brunswick Sales Tax Hst Calculator 2022 Wowa Ca

10 Creative But Legal Tax Deductions Howstuffworks

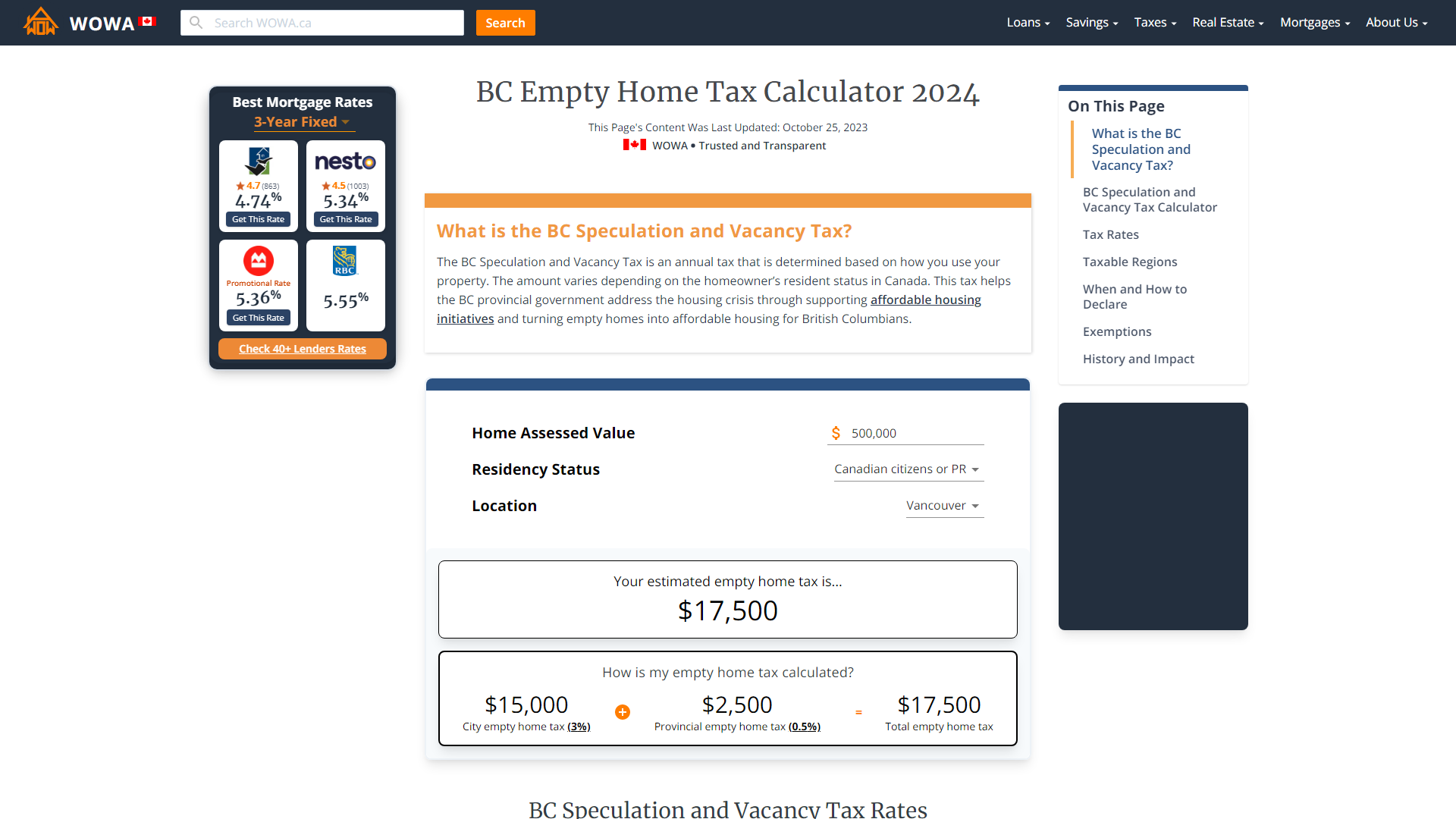

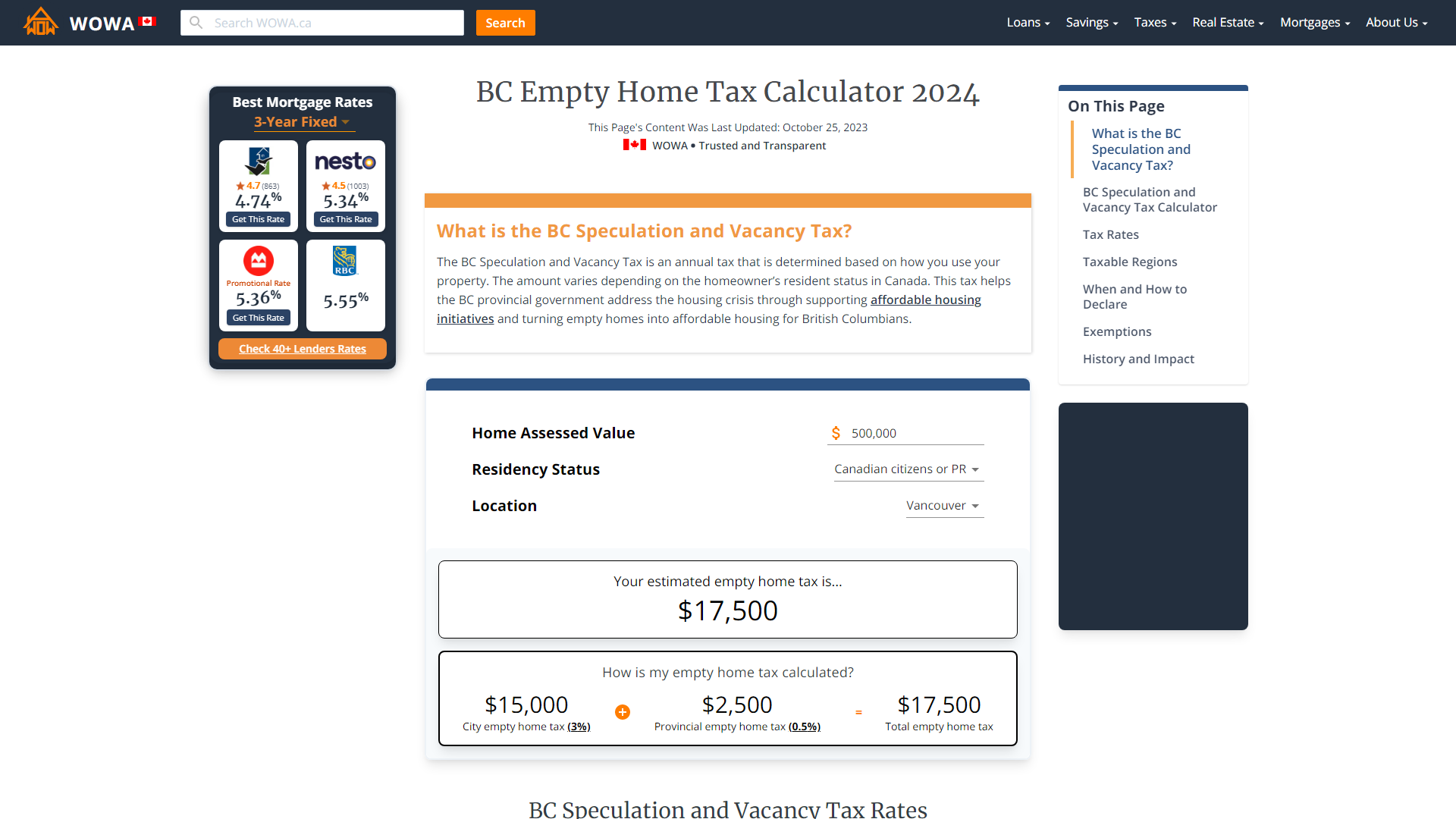

British Columbia Empty Home Tax Calculator 2022 Wowa Ca

Protecţie Proaspăt Costum Canada Personal Tax Calculator Schwarzwald Hotel Org

Land Transfer Tax In Toronto Ratehub Ca

Calculate Import Duties Taxes To Canada Easyship

Land Transfer Tax In Toronto Ratehub Ca

Basic Sap Tax Overview Sap Blogs

Istudy Bookkeeping And Payroll Services Are Common In Eve Payroll Accounting Bookkeeping Payroll

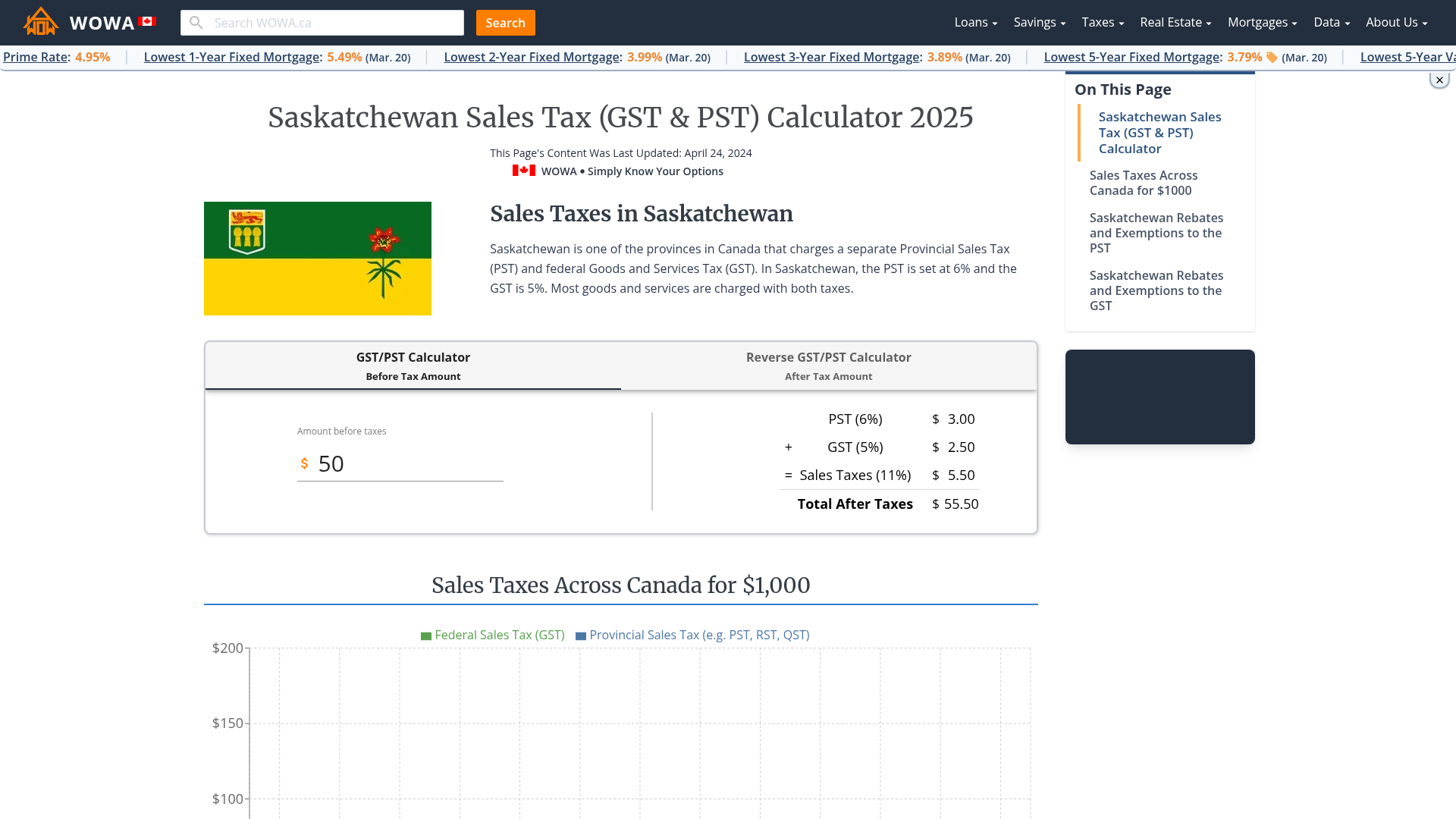

Saskatchewan Sales Tax Gst Pst Calculator 2022 Wowa Ca

Charleston Is A Perennial Favorite Of Conde Nast Traveler Readers Regularly Taking The Top Best Places To Vacation Boutique Hotel Charleston Charleston Hotels